tax forgiveness credit pa schedule sp

Where do I enter this in the program. You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

Under Tax Authority or States go to the Pennsylvania Credits worksheet.

. If youqualify for Tax Forgiveness you must each complete PASchedule SP as if filing jointly. Less Resident Credit from your PA-40 Line 22. End Your Tax Nightmare Now.

You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. Browse Our Collection and Pick the Best Offers. End Your Tax Nightmare Now.

Input line 1 - Input Code for. Taxpayers can apply for tax forgiveness by completing a PA Schedule SP along with their state personal income tax return. And a single-parent two-child family with income of up to 27750 can also qualify for Tax Forgiveness.

To claim tax forgiveness the claimant or claimants must complete and submit PA-40 Schedule SP with the PA-40 Individual Income Tax return. PA Tax Liability from. Less Resident Credit from your PA-40 Line 22.

PA Tax Liability from your PA-40 Line 12 if amended return see instructions 12. Ad 5 Best Tax Relief Companies of 2022. Lacerte will automatically complete Part C Line 1.

Ad Apply For Tax Forgiveness and get help through the process. Nontaxable interest dividends and gains andor annualized. Not only do you include the income you.

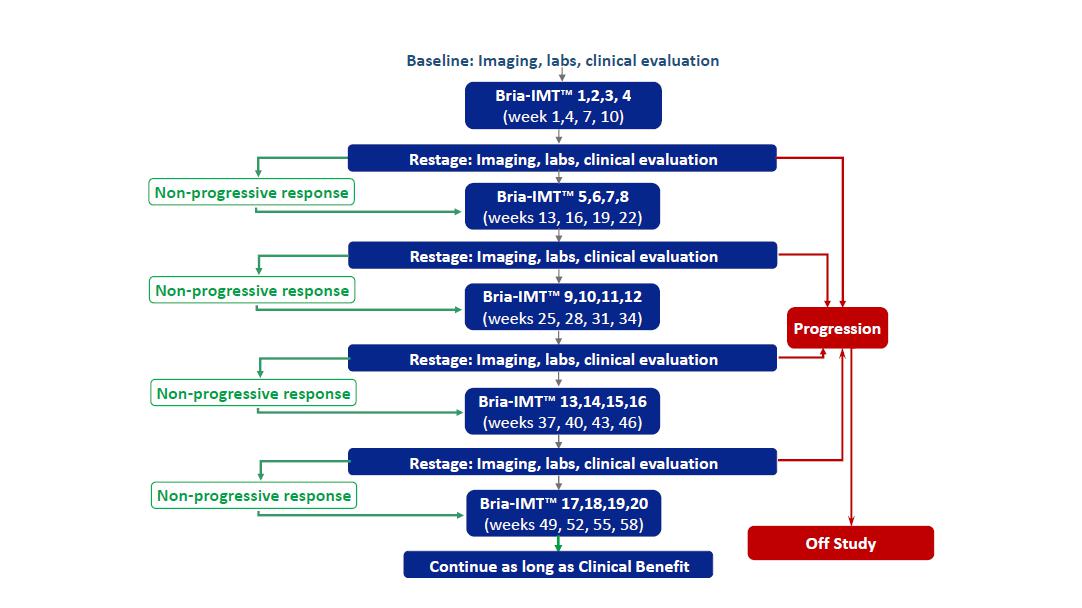

Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the qualifications to reduce all or a part of their Pennsylvania Tax Liability. Schedule SP Part C. Click section 2 - Tax Forgiveness Credit Schedule SP.

You are unmarried for tax forgiveness purposes and your former spouse by agreement or court decree can claim your child as a dependent for federal and PA-40 Schedule SP purposes. To force PA Schedule SP. If you are filing as Unmarried use Table 1.

Ad This is the newest place to search delivering top results from across the web. The Pennsylvania Tax Forgiveness Credit is a credit that allows eligible taxpayers to reduce all or part of their tax liability to PA. Content updated daily for tax forgiveness pa.

PA Tax Liability from your PA-40 Line 12 if amended return see instructions 12. Different from and greater than taxable income. Your eligibility income is different from your taxable income.

You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. First figure out your eligibility income by completing a PA-40 Schedule SP. If you are filing as Married use Table 2.

Ad Tax forgiveness credit pa. A dependent child may be eligible if he or she is a dependent on the Pennsylvania Schedule SP of his or her parents grandparents or foster parents and they also qualify for tax forgiveness. On PA-40 Schedule SP the.

To enter this credit within. Tax Forgiveness Credit Pa. Ad 5 Best Tax Relief Companies of 2022.

Calculating your Tax Forgiveness Credit 12. Calculating your Tax Forgiveness Credit 12. Special Tax Forgiveness PURPOSE OF SCHEDULE Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the qualifications to reduce all or a part of their.

The diagnostic triggers when the taxpayer may be eligible for the Special Tax Forgiveness Credit. Check Out the Latest Info. See if you qualify for all.

Nearly one in five households qualify for Tax Forgiveness. You each must report the sameinformation including dependents and your joint eligibilityincome. PA SCHEDULE SP Special Tax Forgiveness 2020 PA-40 SP EX MOD 08-20 FI 2009610052 2009610052 2009610052 Taxpayers Social Security Number PAGE 2 12.

For the Schedule SP you will include all of your taxable Pennsylvania income along with the following nontaxable income. Move down the left-hand side of the table until you come to the number of dependent children you may.

Deal Imminent Fourth Stimulus Check Update Unemployment Update The The Daily Show Daily News Child Tax Credit

Seven Ways To Come Back To Life After Suffering The Death Of A Loved One Richard Ballo

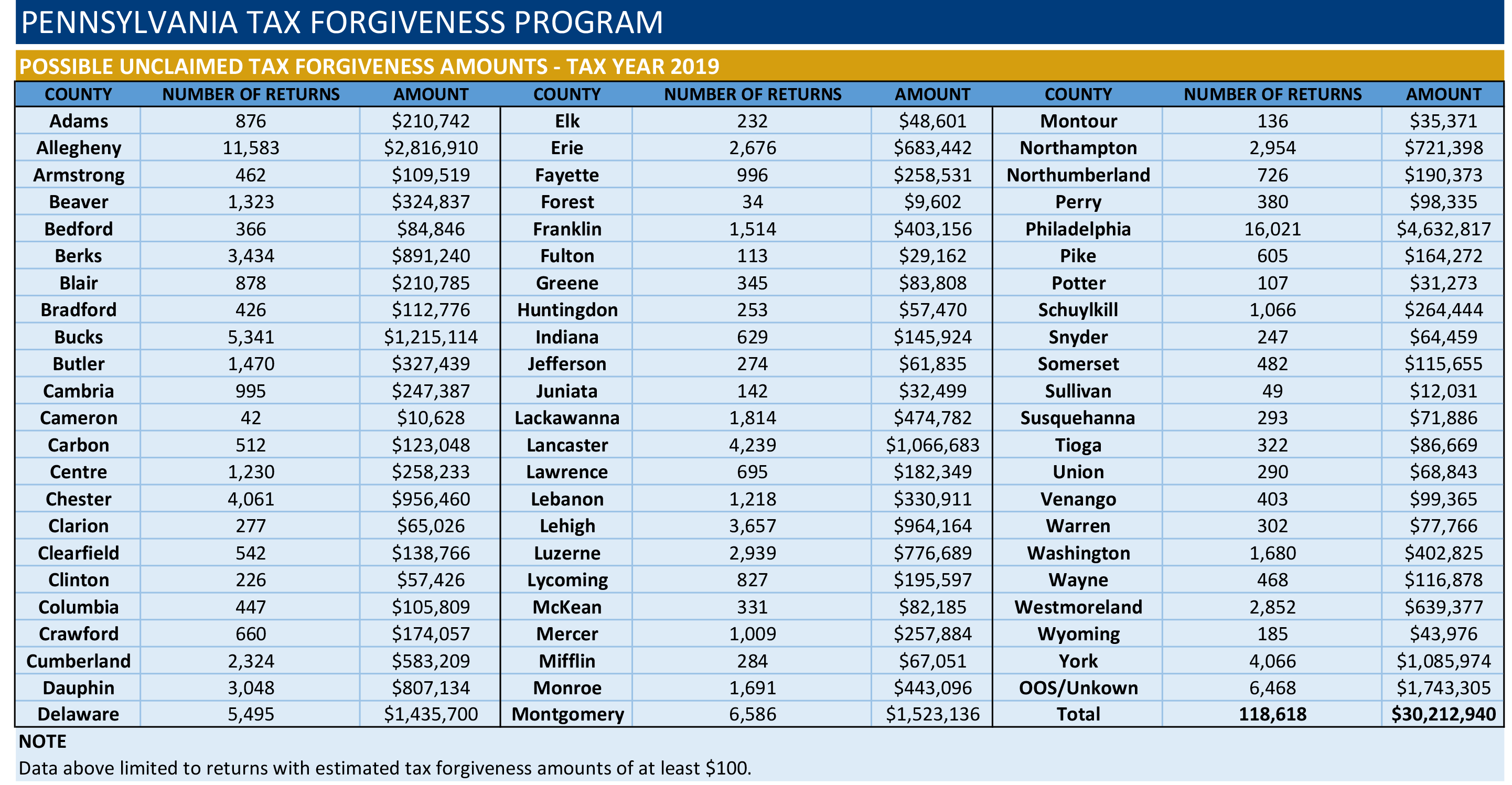

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More

:max_bytes(150000):strip_icc()/how-many-mortgage-payments-can-i-miss-foreclosure.asp-V1-3e102eda72844d3d86f313001f6c2b73.jpg)

How Many Mortgage Payments Can I Miss Pre Foreclosure

Mmoc Christmas Newsletters A D R O P

Machine Learning With R Second Edition Sms Spam Csv At Master Packtpublishing Machine Learning With R Second Edition Github